For many of us, budgeting is one of those tasks we always say we’ll get around to doing — after all, we know it’s important to keep tabs on our money and plan for the future. But amid the busy pace of daily life, it can be tough to track and manage the flow of our money without an easy system to help.

Thankfully, digital tools can make the job a lot simpler. Many of today’s mobile banking apps are built with human psychology in mind — in other words, they can help us harness the power of habit to make smarter spending choices. Here’s how to make these tools work for you:

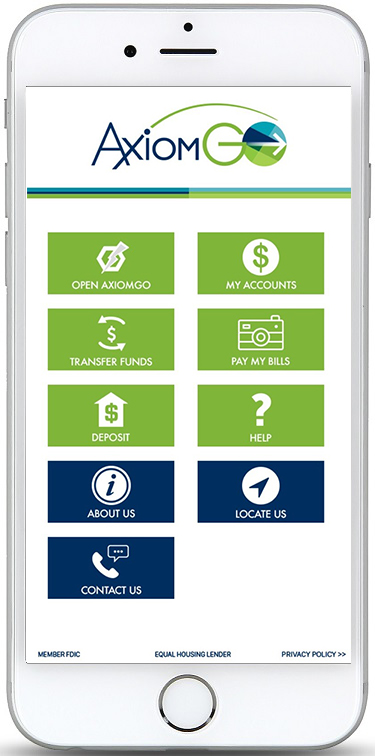

- Start with a plan. Our brains are wired to seek pleasure from achievement. One surefire way to reap the rewards: setting and establishing concrete goals. Saving for a house, car, vacation, or just a rainy-day fund? Make a game out of reaching key milestones along the way. Axiom Bank’s AxiomGO app has an integrated My $ Manager tool that allows you to input your target goals and keep track of progress.

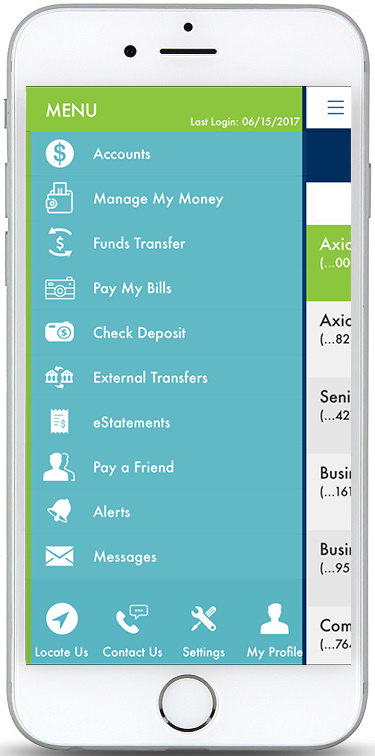

- Get a big-picture perspective. Many of us have a fragmented view of our finances. Look for an app that brings together all your accounts, so you know what’s happening across your entire financial life in real time. With the My $ Manager tool in AxiomGO, you can aggregate checking, savings, loans, 401ks, IRAs and other income streams as well as your debt in one place, without having to sign in to multiple apps or use a complicated spreadsheet. Now, that’s taking control of your financial destiny.

- Keep a lid on expenses. While ignorance can be bliss, it doesn’t help you reach your financial goals. Many folks spend a lot more than they realize on entertainment and convenience options, such as eating out. AxiomGO allows you to cap spending in certain categories, then automatically pulls your debit card transactions into the relevant buckets. For instance, gas purchases come out of your transportation budget. It’s a simple way to analyze spending patterns and make sure you’re on target.

- Take advantage of downtime. Most of us are glued to our phones anyway, so why not use that to your advantage? Spend a few moments in the doctor’s waiting room or in line at the grocery store to review recent spending alerts and track your overall cash flow. It’s an easy way to redeem the time and adopt smart financial practices.

With the freedom and flexibility of today’s mobile banking apps, budgeting doesn’t have to be a laborious or time-consuming challenge. It’s all in finding the right tools and making the power of habit work for you.