What exactly is a credit score, and why is it so important? If you’ve been unlucky enough to be turned down for a mortgage, loan or a credit card limit increase, don’t panic – you’re not alone. For many people, this is the first time they learn that they even have a credit score, let alone be told that their credit rating isn’t high enough to grant them the product they’d applied for.

When you apply for any kind of credit, most lenders will need some form of assurance that you are in a position to repay the money they have lent you, including any interest. To help them assess this, they collect information and calculate a credit score. Generally, the higher the score, the lower the risk it is for them to give you credit.

If you make an application for a loan, mortgage, credit card or other form of borrowing, the lender will perform a credit check on you. The credit check will be used to form part of the lender’s decision-making process to ascertain whether you would be a risky borrower and assess your ability to pay the loan back.

Nevertheless, when it comes to securing a product from Evolution Money, whether it’s a secured or an unsecured loan, a credit score isn’t the be all and end all of the application. We assess the individual as a whole, making sure we take all personal factors and circumstances into consideration when we make our decision. We wouldn’t rely solely on a computer generated credit score on whether to say yes or no.

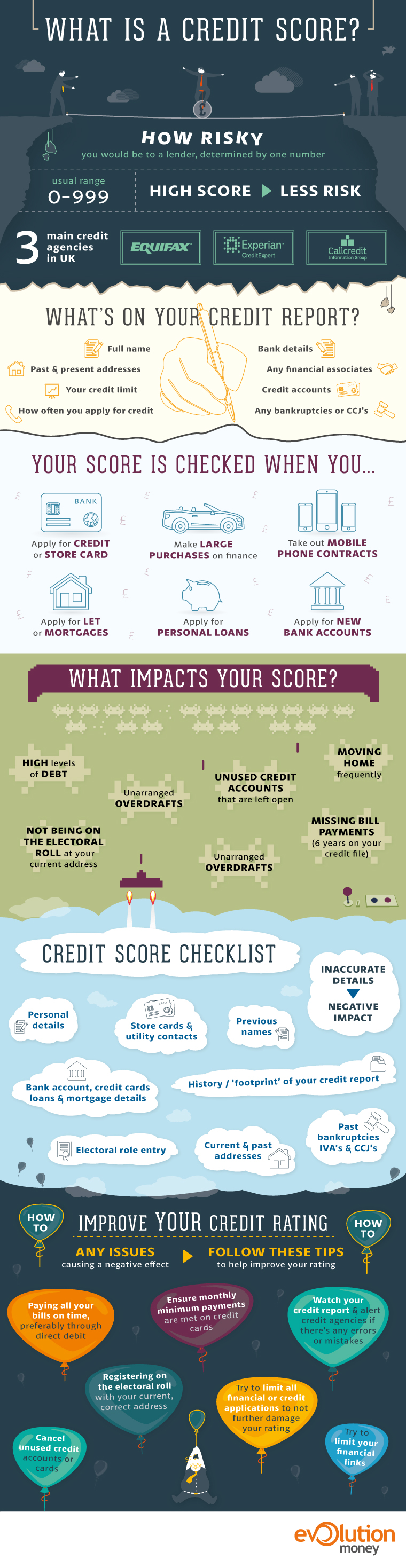

In our new infographic, we break down credit scores to explain how they are generated and what exactly they are used for. We’ve also included some of the most important information that makes it’s way onto a credit report, and what are some of the different ways that credit scores can be improved.

I always take care of my credit scores as this helps me build my reputation when it comes finances and assist me with loan application when needed. Nice article Pauline.

Jayson @ Monster Piggy Bank recently posted…Neat Tricks to Get Your Debt under Control

Incredible story there. What happened after? Take care!